SAP FI - G/L Account

General Ledger (G/L) accounts are used to provide a picture of external accounting and accounts and to record all the business transactions in a SAP system. This software system is fully integrated with all the other operational areas of a company and ensures that the accounting data is always complete and accurate.

How to Create a New G / L Account?

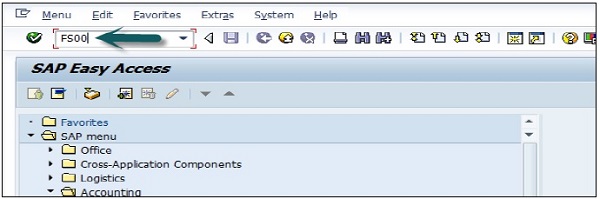

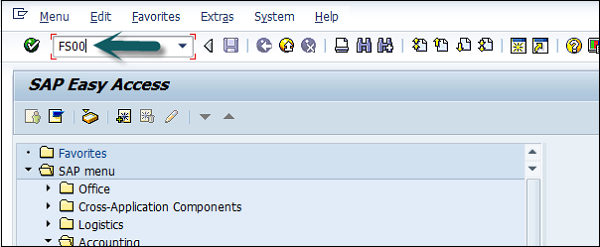

You can use the T-code FS00 to centrally define a G/L account. Refer the following screenshot.

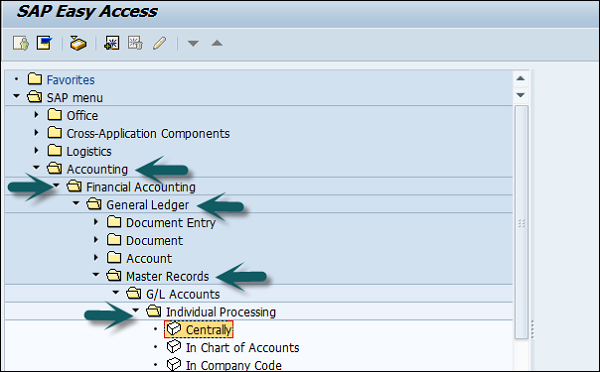

You can also use the following path −

In SAP R/3, go to Accounting → Finance Accounting → General Ledger → Master Records → G/L accounts → Individual Processing → Centrally.

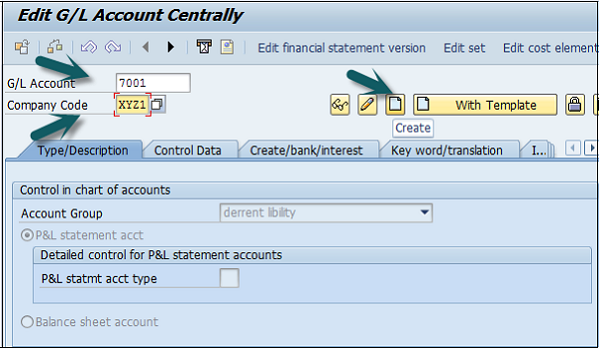

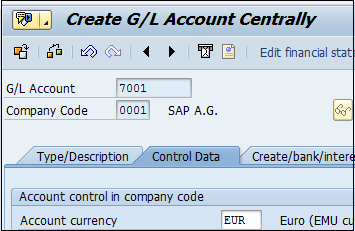

In the field G/L Account, enter the account number of G/L account and the company code key and click the Create icon as shown in the following screenshot −

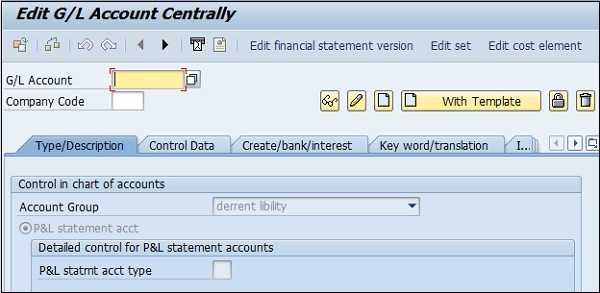

The next step is to enter the details in the Charts of Account.

Account Group

Account Group determines the group for which the G/L account must be created, for example, Administrative Expenses, etc.

P&L Statement Acct

If the G/L account is to be used for P&L Statement Account, then select this option, otherwise use Balance Sheet Account.

Under description, provide a short text or G/L account long text.

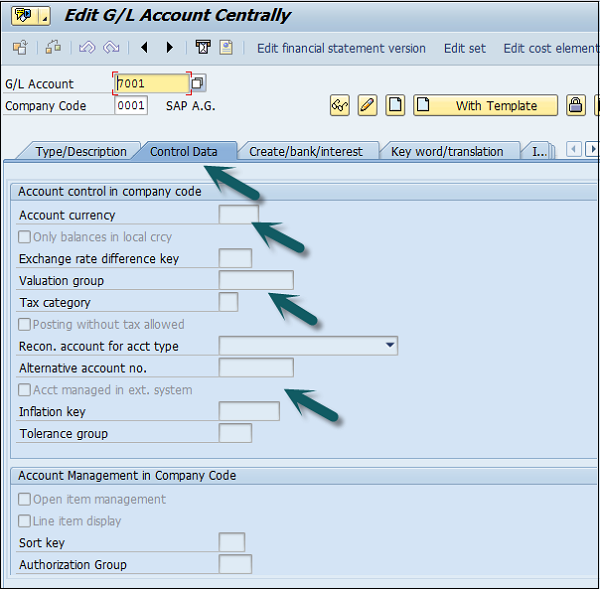

The next step is to click the Control Data and provide data for Account Currency and other fields such as Balance in local currency, Exchange rate difference key, Tax category, posting without tax allowed, Recon account for acct type, alternative account number, Tolerance group, etc. as shown in the following screenshot.

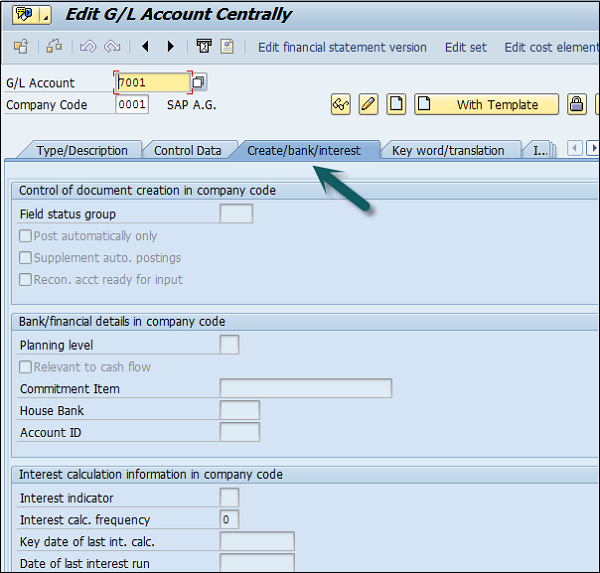

Click Create / bank interest and provide data in the following fields −

Once the details are entered, click the Save button to create a G/L account.

Posting to General Ledger

After you complete the payroll run, the next step is to add results to the GL accounts and this includes cost centers. GL posting includes the following steps −

- Groups together posting-relevant information from the payroll results.

- Creates summarized documents.

- Performs the relevant postings to appropriate GL accounts and cost centers.

How Posting is Evaluated?

Each employee’s payroll result contains different wage types that are relevant to accounting −

- Wage types such as standard salary, bonuses, and overtime represent expenses for the company, which are posted to a corresponding expense account.

- Wage types such as bank transfer, employment tax, employee’s contribution to social insurance, etc. are the employer’s payables to the employee, the tax office, etc. and are posted as credits to a corresponding payables or financial account.

- In addition, there are wage types such as the employer’s health insurance contribution, which represents an expense for the enterprise and, at the same time, a payable to the social insurance agency. For this reason, such wage types are posted to two accounts − once debited as an expense, and once credited as a payable.

Other types of wage types also exist, for example, accruals, provisions, etc. These wage types are usually posted to two accounts, once debited as an expense and once credited as a provision.

No comments:

Post a Comment